Grant Sterling

Engineering & Technical Consultants

TECHNICAL AND FINANCIAL EXPERTS FOR R&D TAX RELIEF CLAIMS AND INNOVATION GRANTS

OFFER

Free Technical Assessment for local businesses

EMAIL US

info@grantsterling.co.uk

What We Do?

R&D TAX RELIEF CLAIMS

R&D projects that might qualify for tax relief

Your company can only claim for R&D tax relief if an R&D project seeks to achieve an advance in overall knowledge or capability in a field of science or technology through the resolution of scientific or technological uncertainty - and not simply an advance in its own state of knowledge or capability.

How to show the project is R&D within the tax definition?

There are guidelines which help in deciding if your company has an R&D project for tax purposes:

• Advance in science or technology: This includes the adaptation of knowledge or capability from another field of science or technology in order to make such an advance where this adaptation was not readily deducible

• An advance in science or technology may have tangible consequences (such as a new or more efficient cleaning product, or a process which generates less waste) or more intangible outcomes (new knowledge or cost improvements, for example).

• A project which seeks to, for example:

a. extend overall knowledge or capability in a field of science or technology; or

b. create a process, material, device, product or service which incorporates or represents an increase in overall knowledge or capability in a field of science or technology; or

c. make an appreciable improvement to an existing process, material, device, product or service through scientific or technological changes; or

d. use science or technology to duplicate the effect of an existing process, material, device, product or service in a new or appreciably improved way (e.g. a product that has exactly the same performance characteristics as existing models, but is built in a fundamentally different manner), will therefore be R&D.

• Even if the advance in science or technology sought by a project is not achieved or not fully realised, R&D still takes place.

• If a particular advance in science or technology has already been made or attempted but details are not readily available (for example, if it is a trade secret), work to achieve such an advance can still be an advance in science or technology.

Why Choose Our Services?

WE CAN HELP IN TURBOCHARGING YOUR R&D EFFORTS

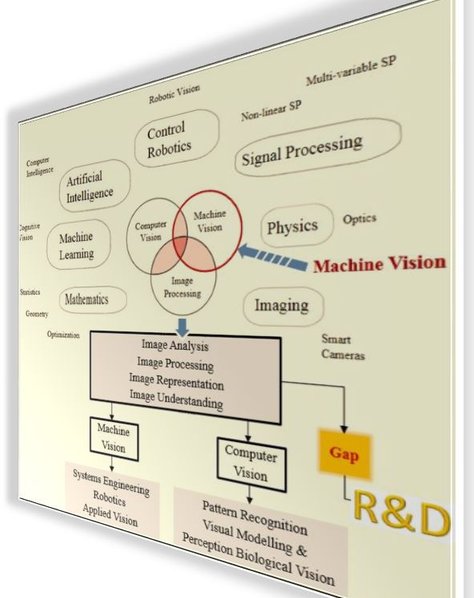

Our technical specialists have hands-on experience in the following areas, which means that we can help you in assessing the technological uncertainties in projects to a far greater depth and extent as compared to management consultancies and accountancies.

SOFTWARE PROGRAMMING

SOFTWARE ARCHITECTURE

DATABASE DESIGN

CAD/CAM

PROCESS AUTOMATION

MANUFACTURING (LUBES, TOOLS, DEVICES)

CONSTRUCTION ENGINEERING

FINITE ELEMENT ANALYSIS

ELECTRONIC CONTROL

FINANCIAL MODELLING

FORECASTING

MONTECARLO RISK ANALYSIS

R&D EXPENDITURE CALCULATIONS

How do we do it?

Steps:

1. Discuss requirements with you

2. Explain the HMRC guidelines

3. Visit your premises for detailed discussions

4. Identify R&D projects

5. Assess technological uncertainties

6. Discuss resources allocated

7. Gather financial information

8. Compute qualifying R&D expenditure and claim amount

9. Prepare technical and financial reports

10. Submit CT600

The key to a successful R&D tax relief claim is the technical report which should explain the technological uncertainties and what actions were taken to overcome these. This requires specialist knowledge of the industry domain, such as software engineering, product development, testing, quality control, manufacturing processes, etc. as well as emerging technology and trends.

The time taken to complete an R&D Tax Relief Claim can range from 3 to 30 days, depending upon the complexity of the project and the availbility of technical and financial information.

ASSESS TECHNICAL ADVANCEMENT IN PROJECTS

Grant Sterling

Engineering and Technical Consultants

Email:

info@grantsterling.co.uk

67 Lincoln Road

Harrow HA2 7RH

Call us:

+44-7833-468995